Ramped + Ready: Silicon Carbide Supply Rises to Meet Innovation Demand

Article

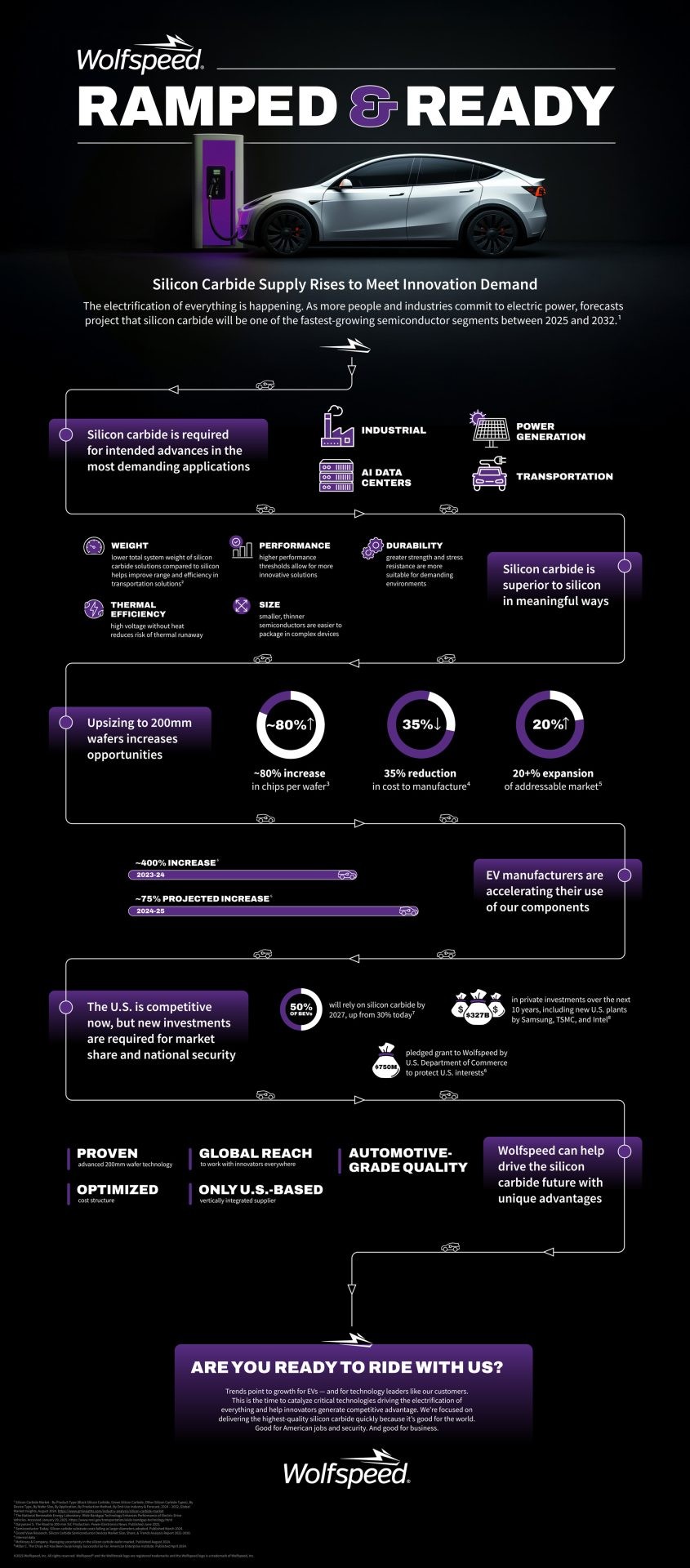

Like so many core industries, global automotive markets are undergoing fundamental change. As more people commit to greener energy sources like renewables-based electricity, EV forecasts project 30% year-over-year growth between 2025 and 2030.1 Despite short-term headwinds and oversupply, EVs are here to stay and will continue to grow as a percentage of the vehicle market. And silicon carbide is an important part of meeting the need.

At Wolfspeed we're bullish on the EV market for a couple of reasons. We are focused on our core business – making the world’s highest-quality silicon carbide – and we are committed to our customers, who need automotive-grade silicon carbide power devices to innovate and thrive. When the EV market hits the tipping point between 2025 and 2030, we believe Wolfspeed will be well positioned. We call it being ramped and ready.

Beyond the EV market, too, silicon carbide power devices are required for intended advances in the most demanding applications across industrial, power generation, transportation, and AI data center markets. The evidence is powerful and undeniable.

5 reasons why silicon carbide is superior to silicon for power electronics

Silicon carbide brings a host of benefits across industries when compared to silicon, but here are some of the most noteworthy:

- Weight: The lower total system weight of silicon carbide solutions compared to silicon helps improve range and efficiency in transportation solutions.1

- Performance: Silicon carbide offers higher performance thresholds that allow for more innovative solutions.

- Thermal efficiency: Silicon carbide’s ability to run at very high voltages without excess heat reduces the risk of thermal runaway.

- Size: Semiconductors made with silicon carbide are smaller and thinner, and therefore easier to package in complex devices.

The most advanced silicon carbide device companies are upgrading their manufacturing to 200mm wafers. The benefits are clear:

- An ~ 80% increase in chips per wafer2

- Modeling suggests that the cost of a 1200V/100A MOSFET die made on a 200mm substrate in 2030 could be 54% less than the cost in 2022, from a 150mm substrate3

- A 20% increase in suitable applications4

Based on these significant improvements, EV manufacturers are accelerating their use of 200mm silicon carbide components. We’ve seen a 400% increase between 2023 and 2024, with a projected increase of 75% on top of this by the end of 2025.5

The national security angle

The U.S. is competitive in silicon carbide today, but new investments are required for our global market share as well as our national security. Fully half of EVs will rely on silicon carbide by 2027, up from 30% today.6

The good news is, $327 billion in private investments have been committed to the semiconductor industry over the next 10 years, including new U.S. plants for companies like Samsung, TSMC, and Intel.7 Highlights on the government investment side include a $750 million grant that the U.S. Department of Commerce has pledged to Wolfspeed.5

That’s not surprising, given Wolfspeed’s proven 200mm silicon carbide wafer technology, automotive-grade quality, optimized cost structure, global reach for innovation partnerships, and its status as the only U.S.-based vertically integrated supplier.

Ramped + ready

Trends point to growth for EVs – and for technology leaders like Wolfspeed’s customers. We believe this is the time to catalyze critical technologies driving the electrification of everything and help innovators generate competitive advantage. We’re focused on delivering the highest-quality silicon carbide power devices quickly not simply because it’s good for the world, or good for American jobs and security. It’s also good for business.

- IEA (2024), Global EV Outlook 2024, IEA, Paris https://www.iea.org/reports/global-ev-outlook-2024, License: CC BY 4.0

- Daryanani S. The Road to 200-mm SiC Production. Power Electronics News. Published June 2022.

- Semiconductor Today. Silicon carbide substrate costs falling as larger diameters adopted. Published March 2024.

- Grand View Research. Silicon Carbide Semiconductor Devices Market Size, Share, & Trends Analysis Report 2022-2030.

- Internal data

- McKinsey & Company. Managing uncertainty in the silicon carbide wafer market. Published August 2024.

- Miller C. The Chips Act Has Been Surprisingly Successful So Far. American Enterprise Institute. Published April 2024.